Is Direct Digital Release a Threat to Theaters?

- By Pawan Lahoty and Kamal Karan --

- june 29, 2020

Direct digital release, COVID-19, Indian Cinema theatres

“We are disappointed with some of our producers deciding to go straight to the streaming platform/s. We were hoping that the producers would accede to our request to hold back their film’s release till cinemas reopen,”

Kamal Gianchandani, CEO, PVR Pictures

Situational overview

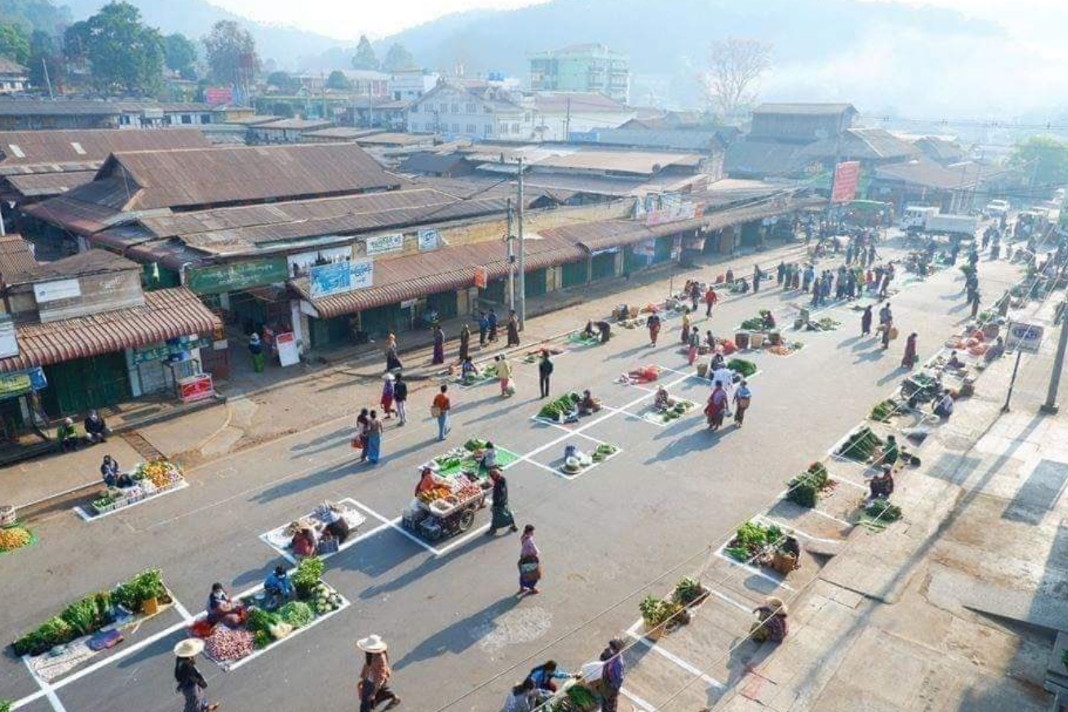

In the past few months, over 95% of cinemas have closed due to the COVID-19 pandemic1. With zero revenues and high fixed costs, liquidity challenges are looming large for cinema theatres. On the other side of the screening spectrum, OTT platforms are benefiting from the COVID-19 with an increase in both subscriber base and average age of subscribers2. In the midst of all this, an interesting trend is emerging in the cinema industry – movies are skipping theatrical releases and are going for ‘direct digital release’ (DDR).

In the Indian cinema industry, there is an exclusive theatrical window for 6 – 8 weeks, and only then the film is made available on OTT platforms like Amazon/ Hotstar, television and Pay Per View (PPV). This practice of exclusive theatrical window is maintained across the globe; however, times lines vary. In India, this duration of 6 – 8 weeks is increasingly shrinking due to pressure from OTT players, who are in a constant battle for better content, and in COVID-19, this theatrical window has ceased to exist. In the last few months, we have witnessed a lot of movies across Bollywood, Regional, and Hollywood industries opting for DDR on various OTT platforms. Few examples from the front of mind are,

This shift in trend has raised a few questions about the future of movie releases. Is DDR a new norm or a temporary phenomenon? Will film producers respect the exclusive theatrical window going forward? Are cinema theatres under threat of competition from OTT, or will they flourish again once the COVID-19 pandemic subsides?

We will have to understand a few key Indian film industry dynamics before starting to answer these questions.

1. Domestic theaters contribute ~60% of film producers’ revenue

Domestic cinema theaters contribute 57% of total film producers’ revenue and another 18% comes from overseas cinemas, whereas digital rights/OTT rights share is only 12-13%3.

2. DDR can result in a lost opportunity for film producers to make higher profits from good content

Typically, film producers/ distributors enter into a revenue-sharing agreement with theater owners. In this setup, film producers have a chance to make bumper profits from quality and popular content, reflected by higher box office collections (BOC). However, in case of DDR, exhibition rights will have to be sold on a cost-plus basis and may result in higher opportunity costs for film producers if the movie could be a blockbuster hit in theatres.

3. Big-budget movies

For big-budget movies, skipping theatrical release may not be economically feasible because realization from the sale of OTT rights is limited. Furthermore, OTT platforms also have limited and predefined budgets for content acquisition. Even in the current crisis, Wonder Woman 1984 (Warner Bros), No time to die (James Bond franchise), F&F (Universal Studio), Sooryavanshi, and ’83 (Bollywood) are examples of some of the big-ticket movies getting postponed instead of going with the flow of DDR.

4. Cinematic experience and outdoor entertainment

The cinematic experience of 70mm screens with Dolby surround sound is unparalleled and some movies are best enjoyed on big screen. Even cinema chains are moving towards premiumization with better screens, broader F&B menus, and convenient booking options to make movie watching more engaging.

5. India is amongst the largest filmmakers in the world

In 2019, 1833 (1776 in 2018) films were released or certified in India, an average 35 films per week.4 As a result, a lot of movies do not get sufficient or favorable slots (timings) in cinema theatres. This may present a case for more and more of small budget/regional movies going for DDR on a cost-plus basis going forward, but this may not significantly impact the content availability for cinema theatres.

6. Co-existence of OTT and theaters

Though viewers currently are streaming content from the comfort of their homes, a recent survey conducted by BookMyShow reveals that 54% of Indians are keen to step out for their favorite movies within 15-90 days of the lockdown lifting. Also, US BOC has grown at a CAGR of ~3%5 from 2014-19 despite the presence of Netflix (1997), Amazon (2005), Hulu (2008). These case studies suggest that OTT and theatres are different mediums of content watching and can co-exist.

Looking at the Indian film industry dynamics, we feel in the short term, DDR is a win-win solution for film producers and OTT platforms as some of the film producers may be struggling for liquidity, and delay in monetization is putting a financial burden on them. Also, there is no certainty about when cinema theatres will open, and even if they open, will there be desired footfalls. On the other hand, OTT platforms are getting content for their increasing subscribers’ base who are spending more time at home.

In the long term, along with OTT platforms there is a possibility of Pay Per View also becoming popular in India, the way it is in the west. Reliance Jio has claimed of ‘First Day First Show’ on JioCinema. It will be interesting to witness how Jio executes it. Furthermore, we believe DDR will have its own share of growth going forward but this will not lead to any paradigm shift in the business model of theatres chains. In the coming future, OTT and Cinema theatres will co-exist and continue to thrive as alternative channels for content watching with one providing comfort of homes and other larger than life cinematic experience.

References:

1OMDIA Research

2Alt Balaji has had an average of 17,000 new subscribers each day in lockdown, a 60% increase from the average of only 10,600 per day in March prior to the lockdown; ZEE5, has registered a 80% rise in subscription numbers; Amazon and Netflix confirmed increase in subscriber but did not share actual numbers - Forbes

3FICCI

4UFO moviez

5Elara Securities Nov’ 19 report

Pawan Lahoty

Kamal Karan