Realty Rebound

- By Akash Mishra

- June 02, 2020

Real Estate, Buyer’s Market, Lock down

The real estate sector has been marred by various factors like project delays, the ongoing crisis in the NBFC sector, RERA, Benami Property Law, GST, demonetization, and low demand. Now it is witnessing a new disruption, the Covid-19 global Pandemic. Will the reeling Indian real estate drown or show resilience in these troubled times? Let us examine it.

The real estate sector of India, including the residential and commercial areas, is a $170 Billion industry, contributing to 7% of India’s GDP and employing a third of India’s labor force. This industry hasn’t historically seen much of technological advancement in operations, which hasn’t helped its productivity.

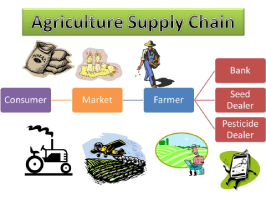

The global Pandemic has caused many commotions, some temporary, and some are long term. The migration of labor forces to their hometowns and supply chain disturbances will increase the construction costs. Around 70% of small-scale developers are predicted to go belly up as they may not be able to sustain the debt burden, which may lead to consolidation of the market forces. Major investors are going to remain in wait-and-watch mode due to caution, and loss aversion led behaviors.

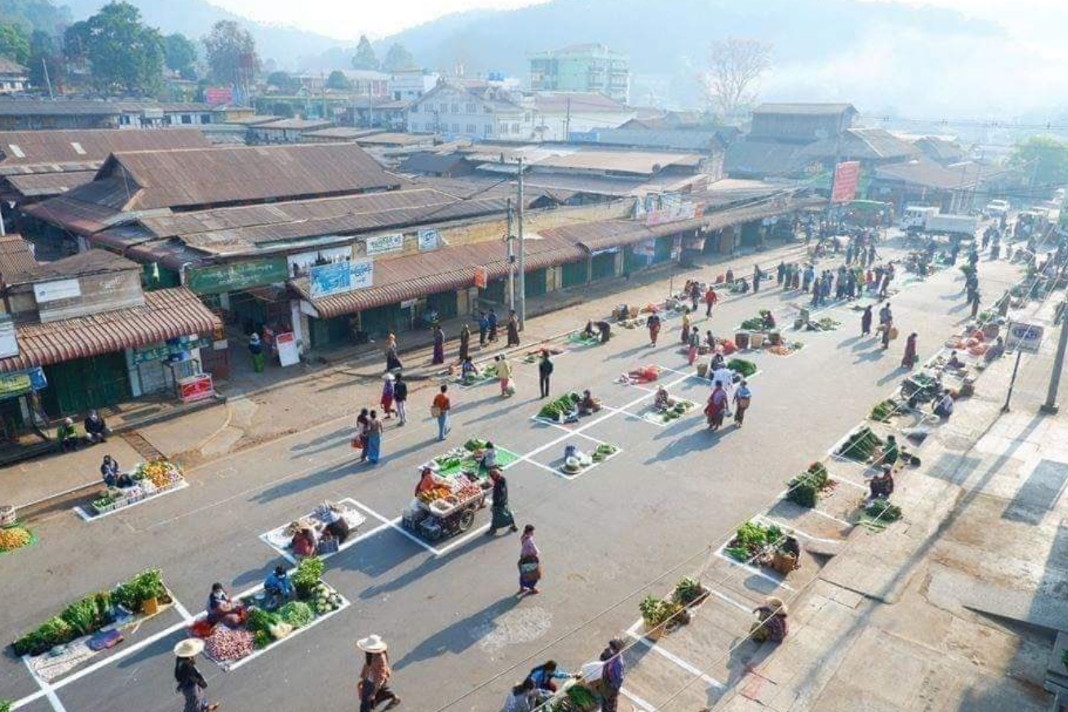

Consumer behavior will also evolve. Most of the consumers may not like to go for huge capital investment. Consumers looking for investing in housing may search for Ready-To-Move properties, which may increase the working capital problems for ongoing projects. The newfound benefits of work from home may dampen the demand for official real estate. Working professionals may look for inclusivity and self-sustainability in housing complexes to suit their WFH requirements. With a decrease in demand, the whole real estate may become a buyer’s market, with the builders doling out freebies and attractive prices to lure in the customers. Increased cost and reduced-price would make the industry’s profit lesser than it already is, which is not sustainable with existing financing woes.

Not everything is gloomy, though, as the Pandemic has created some latent opportunities. Millennials may not prefer shared accommodation because of the fear of COVID and an increased security sense. NRI investments may increase amid falling rupee. The demand for all-inclusive affordable housing may increase. Potential investment areas like data centers, self-sustained buildings, and industrial parks, preventive hygiene cognizant commercial & hospital spaces may increase.

The government has also rolled out measures to help the real estate sector. The reduction of repo rate to 4% is going to reduce the interest rate of home loans. The moratorium period for significant term loans has been increased by three months. Liquidity injection of 3.74 Lakh Crores INR has been approved under the 20 Lakh Crore “Atmanirbhar Bharat” fiscal stimulus package. The ongoing projects’ deadlines can be extended up to 6 months under RERA, citing the force majeure clause.

Still, a lot can be done to revive from the current situation. Structural changes have to be brought in to the thinking of future facilities. Health and hygiene, along with self-sustenance, have to be incorporated into all future designs. Measures like rewiring the contractual framework, rethinking design and engineering processes, reskilling of the workforce, adopting digital technology and automation, localizing the supply chain, and improving on-site construction have to be quickly taken. Regulatory changes like shortening of approval processes and fiscal help like tax incentives & GST reduction can cause a significant morale boost.

The future is full of uncertainties and challenges, but with an adaptive mentality and resolute mind-set, every problem can be overcome. The real estate sector is undoubtedly in a lousy shape. However, the time is ripe for rethinking the strategy and coming up with a more adaptive and resilient system.

Akash Mishra